Hopes are riding on an alcohol duty freeze in next week’s budget

- Catherine Fielden

- The World of Slurp

- 22 Oct 2021

-

83views

On 27 October, Chancellor Rishi Sunak will deliver his Budget and Spending Review to the House of Commons as he seeks to rebalance the books after borrowing billions in order to protect the economy during the Covid pandemic. However, there is concern that the Chancellor – who is teetotal – will raise alcohol duty in his upcoming announcement at a time when the UK is facing higher living costs due to hikes in energy prices, rising inflation and the withdrawal of the universal credit uplift.

Excise duties in the UK are already high compared to those of our European peers. If Mr Sunak chooses to raises excise duties in line with RPI next week, the price of a typical bottle of wine will increase even further by 2.2. This means that that 55% of the cost of your wine will be going straight into the government’s coffers.* In light of the crippling living costs now affecting many families in the UK, think tanks and lobbying groups are calling for a freeze on excise duty. Such a measure would also help the still-struggling hospitality sector to recover post-Covid.

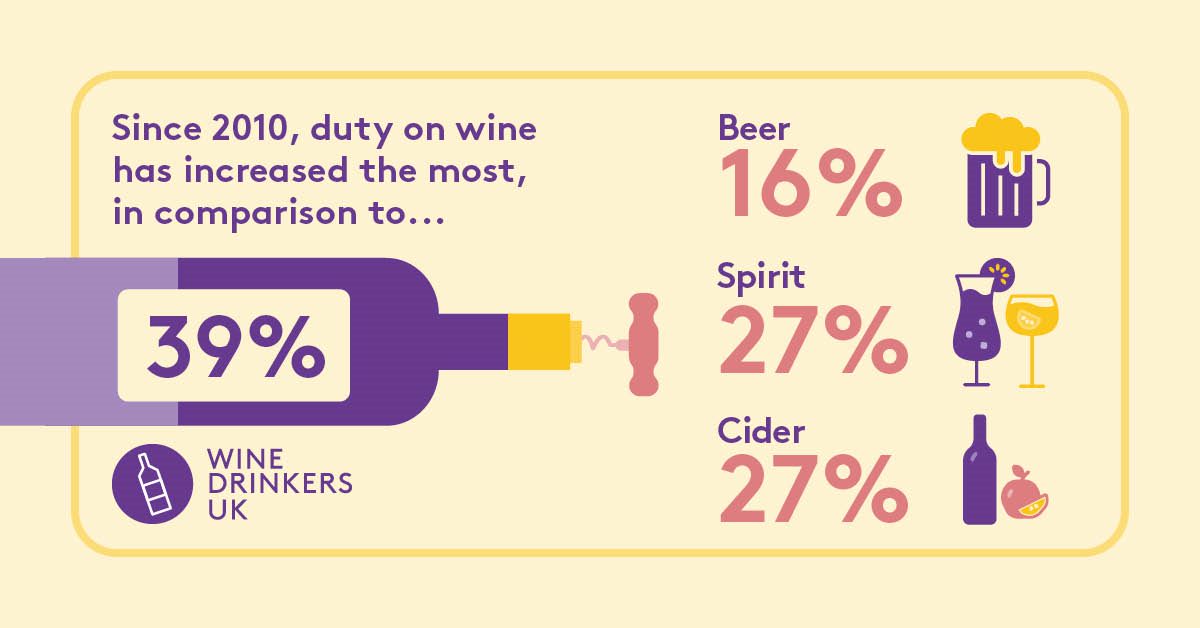

There is additional pressure on the Chancellor to remove the existing unfairness in the existing UK alcohol taxation system. Wine Drinkers UK, a collection of wine lovers, producers and merchants, have highlighted the fact that women pay more tax and VAT on alcohol. This is because beer is taxed at a more favourable rate compared with wine. Since 2010, tax on wine has risen by 39% while duty on beer has only increased by 16%. They argue that this has resulted in an unfair gender bias as women are far more likely to choose wine over beer while the reverse is true for men.

A YouGov Survey for Wine Drinkers UK found that 43% of women listed wine as their favourite tipple, with only 7% choosing beer. In contrast, just 21% of men selected wine as their alcoholic drink of choice, with beer coming out on top at 44%. Campaigners, including TV personality Kate Thornton and Tory MP Nusrat Ghani, cannot understand why wine isn’t treated in the same way as beer and spirits when it comes to tax and hope that Mr Sunak will make addressing this issue a priority.

There has been speculation that tax on sparkling wines will be cut, however, and brought into line with the amount levied on still wines. Currently, sparkling wine is subject to 30% higher tax than still wines. Scrapping premiums on bubbles would be hugely beneficial to English and Welsh winemakers because sparkling wine comprises around 70% of wine production across the two nations.

When all is said and done, any alcohol cuts or freezes will come as a welcome relief to wine, beer and spirit drinkers. This is at a time when the Wine and Spirit Trade Association (WSTA) warns that we’ll all be facing record high prices this Christmas due to the impact of Covid, Brexit red tape, HGV driver and other staff shortages. Keeping alcohol duties on ice for now might just ease people’s financial pain a little over the festive period.

*Source: Centre for Policy Studies

By Catherine Fielden